Agentic AI upshift in China

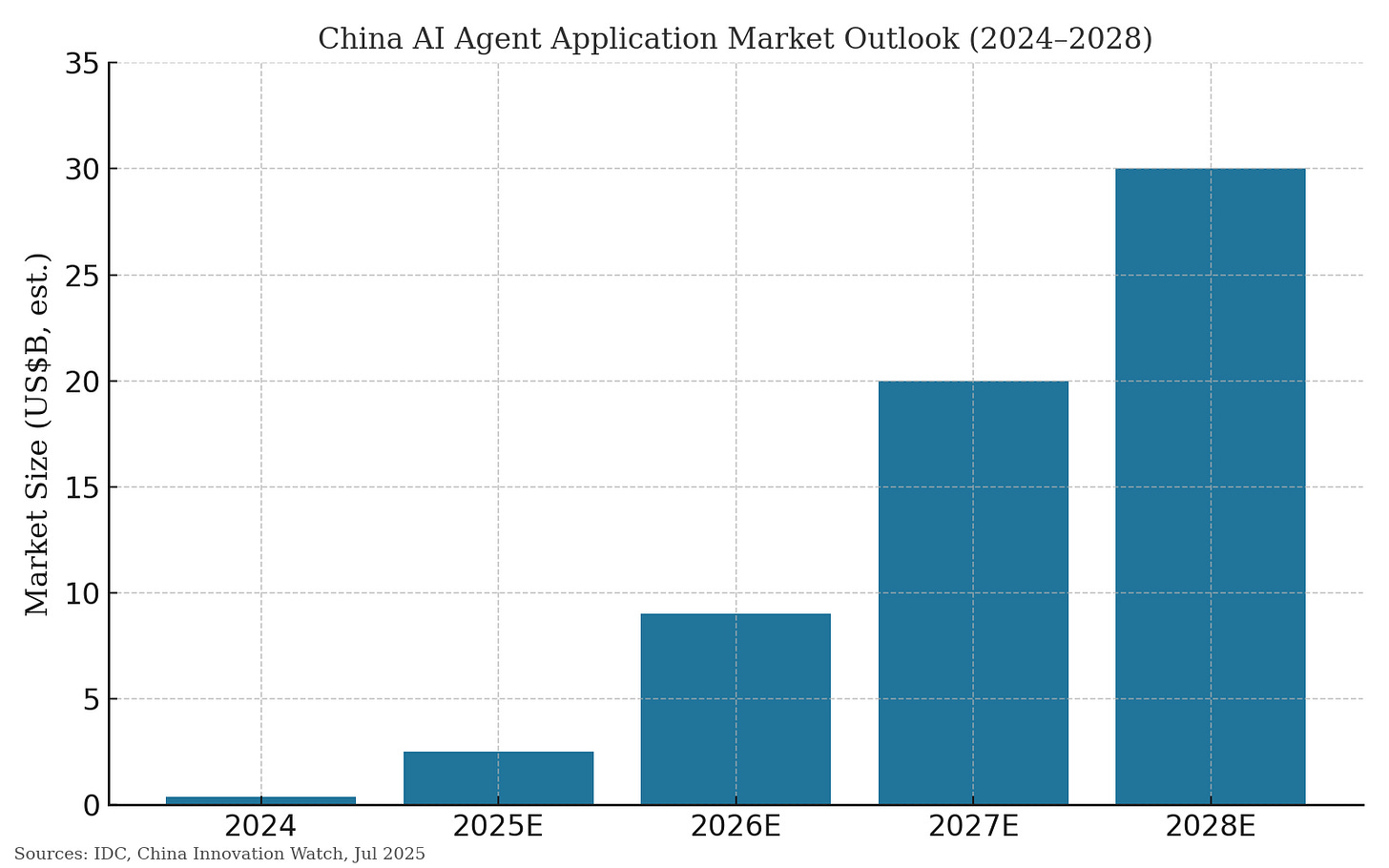

AI agent market in China to surge 75× by 2028 as tech giants race to standardize.

AI infrastructure spend in China jumps from $3.4B to $23.1B by 2028, eclipsing software growth.

"Agentic AI" mentions spike 250% QoQ, while copilot narratives fade

97% of CIOs plan to invest in AI agents, but only 22% have a clear strategy.

China’s AI Agent sector scales from under $1B in 2024 to over $30B by 2028

Alibaba, Baidu, Tencent, and ByteDance deploy MCP-based stacks to scale agent services across cloud, apps, and developer tools

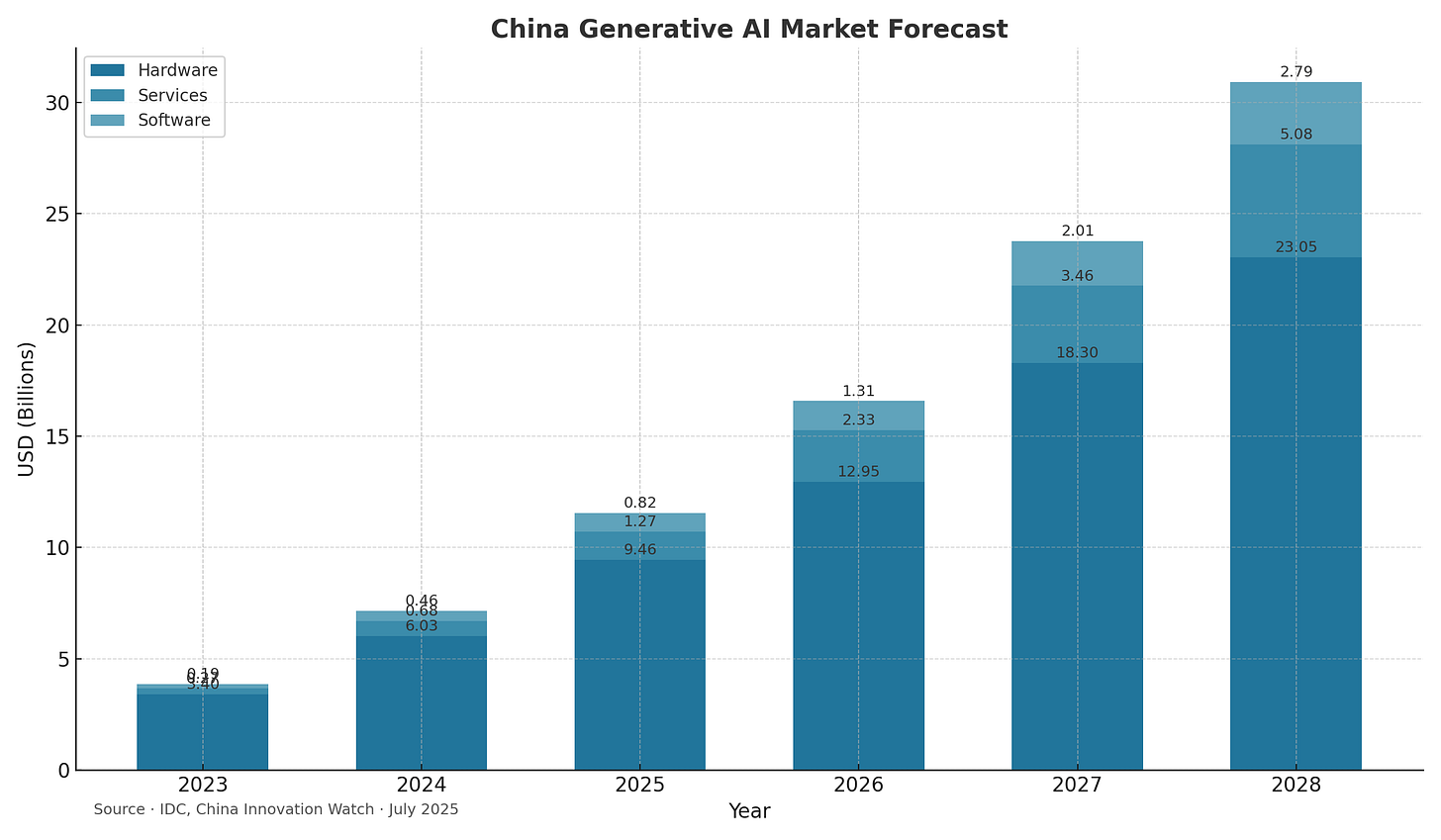

China's generative AI market will surge from $3.9 billion in 2023 to $30.9 billion in 2028, led by infrastructure spend, according to IDC.

Hardware alone scales from $3.4B to $23.1B, while software lags at $2.8B in 2028.

Surge of a new buzzword

Agentic AI roars onto earnings calls this quarter, leaping from statistical noise to 0.6 % of transcripts—a 250 %sequential jump, signaling fresh C-suite curiosity (IoT Analytics, Q4 2024 CEO Insights).

"Copilot" mentions peak in Q2 2024 at 2.8 % of companies but slide to 1.4 % by year-end, while "chatbot" talk hovers near 0.9 %, hinting at narrative fatigue (same source).

Agentic AI moves from hype to planning stage

Nearly all surveyed CIOs by IDC (97%) say they are ready to invest in Agentic AI, but only 22% have formalized a strategy.

Meanwhile, 64% still haven’t defined a clear path forward. Adoption is high on intent, low on execution.

By late 2024, enterprises will rely on AI for insight suggestions.

Come 2026, entire workflows, such as refund handling and customer support, may be fully run by AI teams, with humans coordinating rather than controlling according to Aura Ventures.

China’s AI Agent market is on the cusp of a structural leap forward, with 2025 poised to mark a pivotal transition from experimental pilots to scaled deployments.

As digital transformation accelerates under favorable policy tailwinds, IDC projects a steep trajectory in enterprise adoption.

Keep reading with a 7-day free trial

Subscribe to China Innovation Watch to keep reading this post and get 7 days of free access to the full post archives.