How BYD beats Tesla for fourth straight quarter

Chinese automaker sells 582,522 pure EVs in Q3 2025, beating Tesla by 85,423 units as overseas expansion accelerates

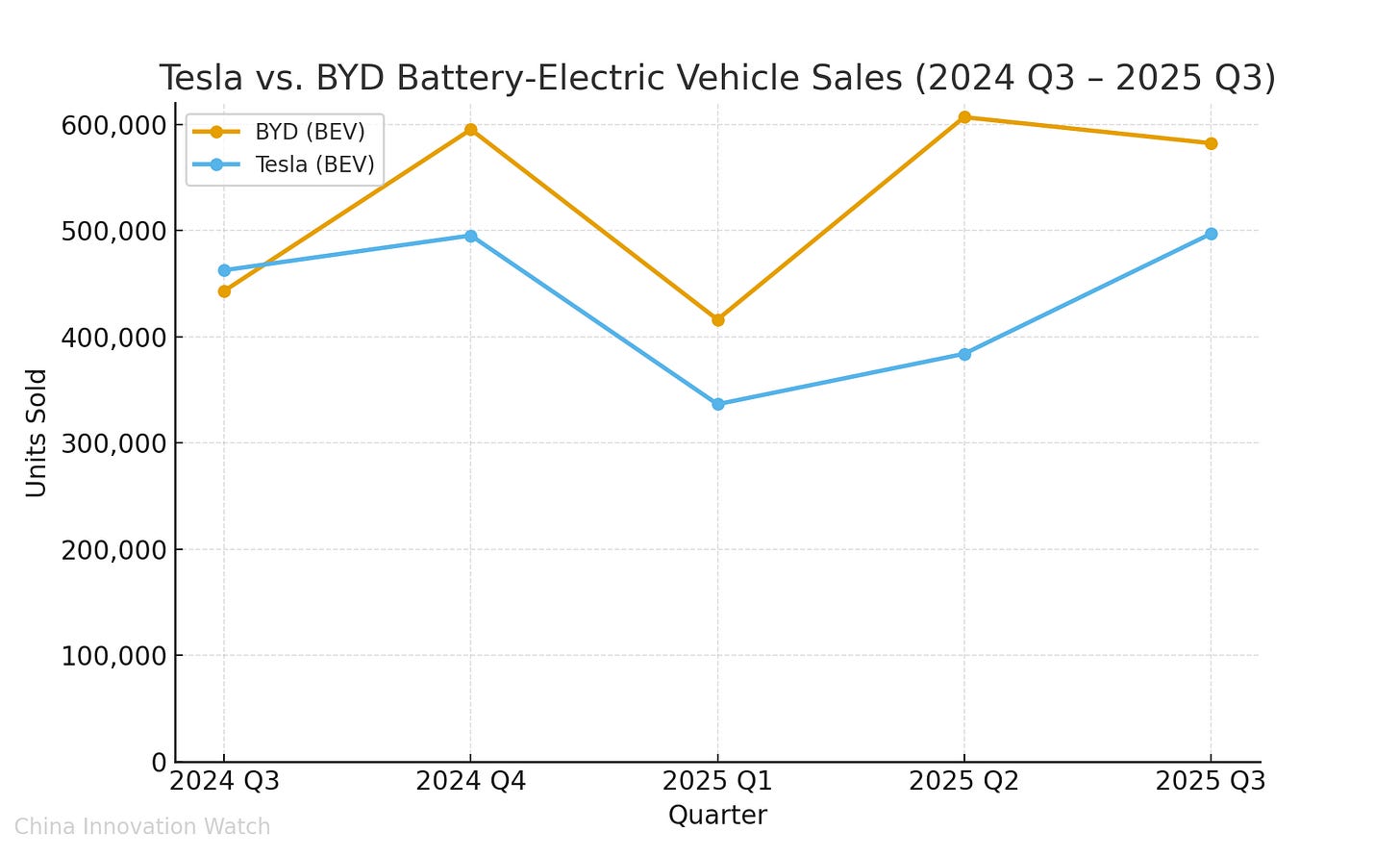

Delivered 582,522 pure electric vehicles in Q3 2025, surpassing Tesla’s 497,099 units by 85,423 in the fourth consecutive quarter

Year-to-date pure EV sales reach 1.606 million units, ahead of Tesla’s 1.218 million by 388,000 vehicles

Bloomberg analysts project 2.17 million annual pure EV deliveries for BYD versus 1.61 million for Tesla

Overseas sales exceeded 700,000 units through September, with BYD outselling Tesla in Spain, France, Italy, Austria, Singapore, Thailand, and Malaysia during August 2025.

Targets 800,000+ overseas units in 2025, up 92% year-over-year

BYD claimed the global pure electric vehicle crown for the fourth straight quarter in Q3 2025. The company delivered 582,522 units compared to Tesla’s 497,099, an 85,423-unit margin that signals a structural shift in EV market leadership.

Counterpoint Research projects BYD will finish 2025 as the global electric vehicle sales leader with a 15.7% market share. This marks the first time a Chinese automaker has overtaken Tesla on an annual basis.

The Q3 performance extends a winning streak that began in Q4 2024. That quarter marked BYD’s first victory over Tesla in pure EV sales.

Through the first nine months of 2025, BYD has delivered 1.606 million pure electric vehicles versus Tesla’s 1.218 million. The 388,000-unit gap exceeds Tesla’s entire Q3 delivery total.

Dual-platform strategy separates BYD from Tesla

BYD’s total new energy vehicle sales reached 3.26 million units in the first three quarters of 2025. Pure electric models account for 49.26% of volume at 1.606 million units.

The remaining 1.654 million units come from plug-in hybrid vehicles. This is a category where BYD dominates while Tesla offers zero competing products.

This dual approach captures customers across the electrification spectrum:

Pure EVs target buyers with established charging infrastructure

PHEVs appeal to consumers in regions with limited charging networks or requiring extended range

Bloomberg analysts forecast BYD will deliver approximately 2.17 million pure electric vehicles in 2025. Consensus estimates for Tesla stand at 1.61 million units.

This 560,000-unit projected gap represents more than three times Tesla’s Q3 delivery volume. The margin suggests BYD’s lead will widen substantially by year-end.

BYD outsold Tesla on a quarterly basis despite registering its first total sales decline in 18 months during September. The company maintained year-over-year growth momentum even as sequential volumes dipped. This indicates resilience against softening domestic demand.

Beyond China: BYD wins on Tesla’s home turf

BYD’s gains in traditionally Tesla-dominated markets signal geographic diversification beyond its Chinese base. The offensive spans three fronts: Europe, Southeast Asia, and the Americas. Localized production anchors each expansion.

Europe: Six-country sweep in August 2025

BYD outsold Tesla in Spain, France, Italy, Ireland, Portugal, and Austria during August. These represent six of Europe’s major automotive markets.

S&P Global Mobility expects BYD to more than double European sales from 83,000 units in 2024 to 186,000 units in 2025. Volumes should reach nearly 400,000 units by 2029.

This trajectory would establish BYD as a top-five European EV brand within four years. The company would challenge legacy manufacturers Volkswagen, BMW, and Mercedes-Benz on their home territory.

The European offensive advances despite tariff headwinds:

EU imposed additional duties on Chinese-made EVs in 2024

BYD faces lower rates than competitors due to cooperation with investigators

Company accelerated local manufacturing to sidestep trade barriers

BYD operates production facilities in Hungary and Turkey to serve European customers while satisfying local content requirements.

The Hungary plant in Szeged began trial production in 2025, targeting 150,000 annual units. Turkey’s facility adds capacity outside EU jurisdiction while accessing Middle Eastern and North African markets.

Southeast Asia: Manufacturing proximity drives market share

BYD outsold Tesla in Singapore, Thailand, and Malaysia during August 2025. The company leverages its Thailand manufacturing base operational since 2024.

The Thailand plant produces right-hand-drive models for regional distribution. This approach slashes logistics costs and delivery times versus China-sourced vehicles.

Americas: Multi-country manufacturing hedge

BYD operates Brazil’s Camaçari Industrial Complex in Bahia state and committed to facilities in Mexico.

These investments position production near end markets while diversifying supply chains across Western Hemisphere time zones.