China’s next interface: AI companions

Fusing tactile design with emotional intelligence, China’s AI companion boom is reshaping global norms in consumer tech, monetization, and intimacy engineering.

China leads the AI companion boom, fusing plush toys with generative AI to tap into an $11 billion domestic market by 2026.

Products like Ropet and BubblePal show how China's startups are integrating GPT-powered personality engines into temperature-controlled, tactile shells.

Local VCs, including traditionally cautious investors like GSR Ventures, are backing emotion-first tech aimed at Gen Z and single adults.

The next battlegrounds: emotional AI regulation, data privacy, and how long users will pay for friendship.

At 10 PM, as you shut your laptop, a fluffy, round creature in the corner of your desk blinks its sleepy eyes. You stroke its head, feeling a gentle warmth and a furry texture as it emits a soft purr. This isn't a scene from a sci-fi film; it's the rapidly emerging reality in China's tech scene, where AI companions are evolving from simple chatbots into sophisticated, physical "pets."

AI companions—digital or robotic entities designed to offer emotional support—have gone from sci-fi fantasy to serious business.

While the U.S. and Japan pioneered early conversational bots, China is now the fastest-moving hub for AI companions, propelled by generative AI, a maturing toy-tech ecosystem, and deep emotional demand from a mobile-first generation.

China’s emotion economy takes shape

The concept of companionship tech is colliding with China's booming "Chao Wan" (trendy toys) industry.

Pop Mart’s market cap surged from HKD 27.3B to 366B within 18 months thanks to blind box collectibles, showing clear demand for emotionally charged, character-driven products.

Layer AI on top, and the result is a fast-emerging hybrid: "AI Chao Wan" (AI-powered collectible companions).

Startup MoeFriend’s Ropet epitomizes this fusion. The device resembles a plush pet, emits body warmth at 37 °C, and mirrors user emotions through facial tracking, GPT-powered dialogue, and expressive LED “eyes.”

In January 2025 alone, Ropet raised over USD 1 million on Kickstarter, selling 900+ units—70% to female buyers, many in their 20s and 30s.

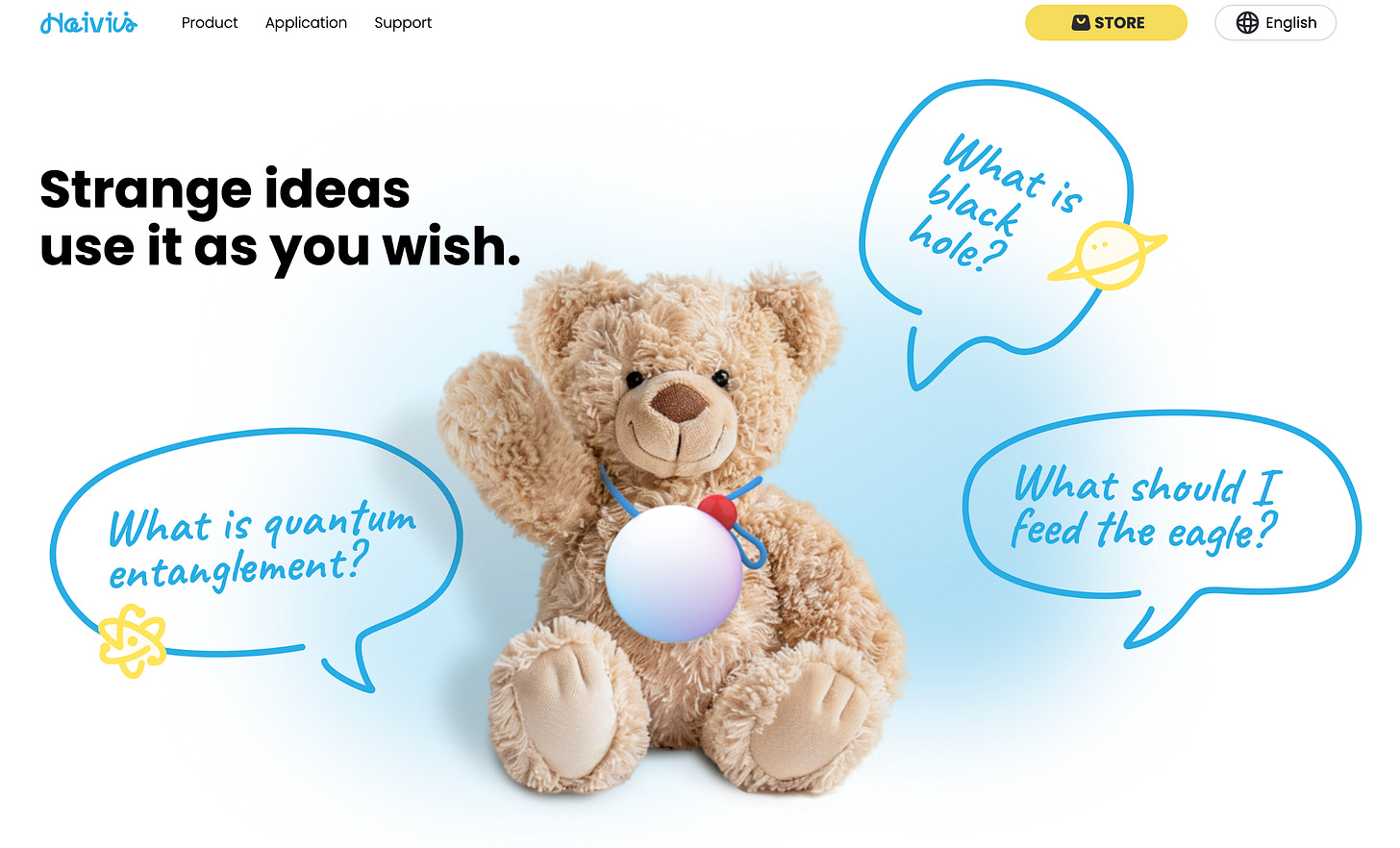

BubblePal, developed by Haivivi, took a different tack—selling 250,000 clip-on AI plushies in under 12 months.

These toys talk, react to touch, and use pre-trained models to simulate childlike dialogue. Most sales came through direct-to-consumer channels, often via social video platforms like Douyin.

Capital chase and changing VC logic

The surge in AI companion products has turned even skeptical VCs into believers. Zhu Xiaohu, GSR Ventures’ managing partner, previously known for his caution on "embodied AI," led a seed round for Fuzozo, a new AI pet startup from Shanghai.

Why the pivot? Investors cite strong consumer stickiness, an underserved emotional economy, and China's proven ability to commercialize hybrid formats.

As Zhu put it: “This team isn’t chasing AGI—they’re going for the near-term monetization sweet spot.”

Meanwhile, Tencent, iFlytek, and Alpha Startups are investing in “AI + education + emotion” models, particularly those targeting children and elderly users. The thesis: emotional interaction will be the gateway to China’s future household AI.

Capital is following three major trends:

“AI + Emotional Value” (e.g., Gen Z bonding experiences)

“IP + AI” Fusion (leveraging characters with built-in fanbases)

“AI + Education” (child-focused companions with learning functions)

Japanese endurance, western caution

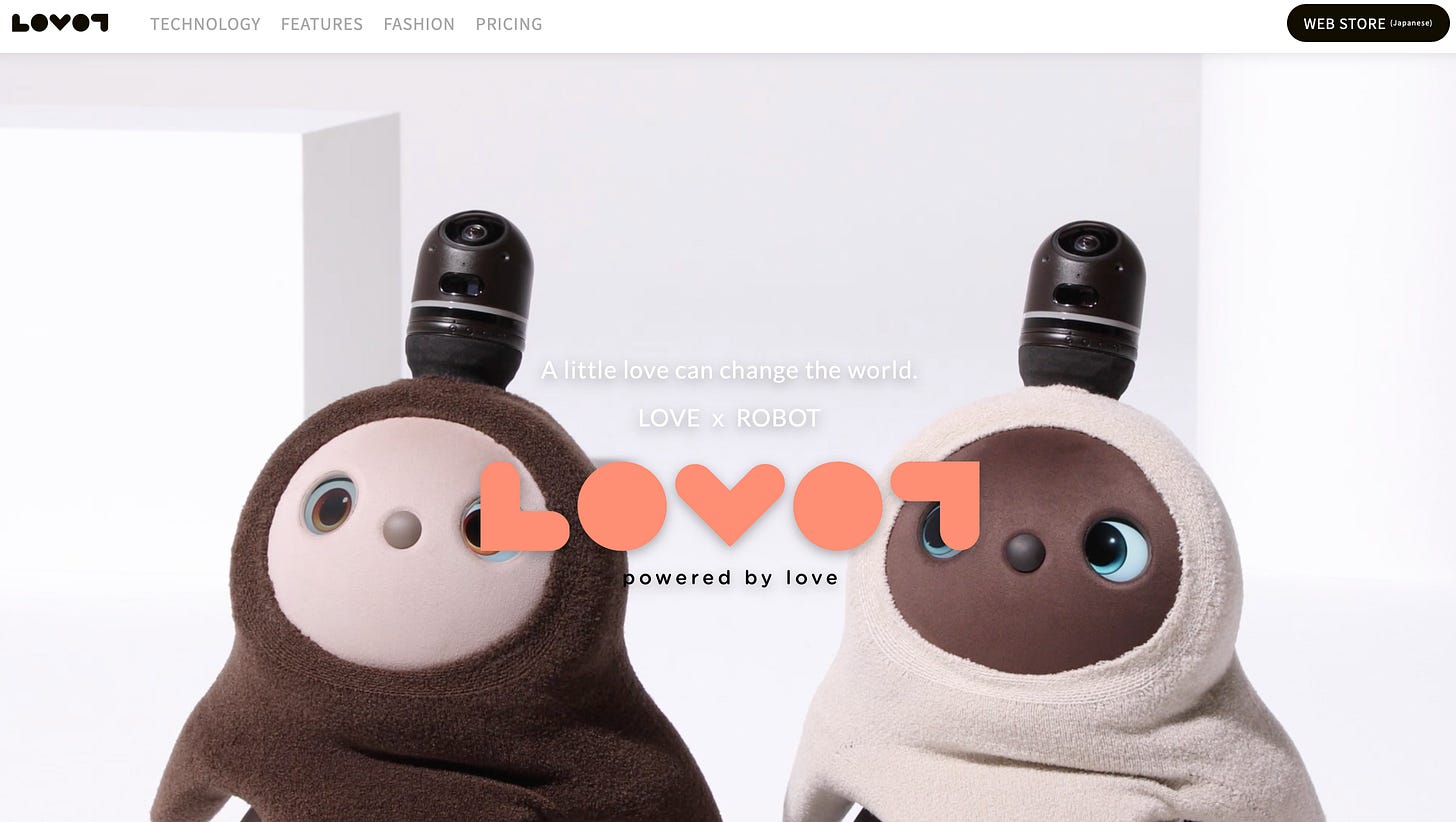

Japan offers a glimpse into long-term viability.

Lovot, priced at USD 3,000 with a USD 80 monthly fee, boasts a 90% three-year daily active usage rate. The key? Not conversation, but tactile warmth, consistent behavior, and user “bonding.”

This contrasts with U.S. players like Replika and Character.AI, which rely on text-based relationships and suffer from churn and controversy.

Replika’s reported 25% free-to-paid conversion and Character.AI’s USD 5 billion valuation highlight global demand—but lawsuits and moderation challenges have clouded growth prospects.

In contrast, China's AI toys are designed around trust, limited expressiveness, and tight parental control features, making them more culturally palatable in Asian households.

Infrastructure matters: supply chain to sensors

China's edge isn't just in cute designs or clever marketing. It lies in vertical integration. Many of the top players—such as MoeFriend—own or co-develop their own haptics modules, camera boards, and voice chips.

Shenzhen-based OEMs are already prototyping temperature-sensitive faux fur, low-latency emotion recognition engines, and cloud-edge inference hybrids to reduce operating costs.

Unlike Western software-first models, China's AI companion startups monetize across the stack:

Hardware sale (entry ticket)

Monthly “skills” packs (personality upgrades, new games)

IP-themed accessories (limited edition costumes, seasonal voices)

Social graph extensions (connect pets, share user stories)

This multi-revenue path keeps average revenue per user (ARPU) resilient and allows emotional bonds to compound over time.

IP, character arcs, and long-term memory

A defining characteristic of Chinese AI companions is their “Yang Cheng” (growth-based) bonding model.

These aren't just static personalities. They evolve. They remember. Ropet’s engine, for example, builds a “relationship graph” based on mood, conversation themes, and physical interactions. Over time, users feel like they’re raising—not just talking to—their digital pet.

Brands are leaning in.

BubblePal now licenses characters from Peppa Pig, Frozen, and Doraemon, bundling voice skins and co-branded shells. The goal: combine Pixar-grade storytelling with personalized AI evolution. This is where China’s companion economy starts to resemble a “Netflix for relationships.”

Societal fuel: loneliness and generational shifts

Underneath the tech lies a powerful emotional driver: the loneliness economy.

China has 240 million single adults

Its aging population will exceed 400 million by 2035

According to Tencent Research Institute, only 4.6% of people feel fully emotionally supported

Among those surveyed, 98% said they would consider AI companions to help with isolation, and 48% preferred confiding in bots to avoid burdening others.

As Professor Wei Xiang from CASS Business School notes: “Smart pets are not just entertainment—they are psychological infrastructure.”

Failure cases and hard truths

Not all entries succeed. Super ZaiZai, an AI toy firm that raised RMB 50 million in 2023, shut down in 2024 without launching a product. Its downfall? Over-indexing on IP licensing and underbuilding AI core features.

Another trap is “distribution dependency.” Many startups rely on Tmall, TikTok Shop, or influencer live streams to sell. Without owned retail channels or community-building mechanics, margins shrink fast.

And as product categories converge, feature differentiation becomes razor-thin. Sound detection, “eye” displays, even haptics—these are now commoditized. The future lies in narrative control, long-tail emotional memory, and seamless OTA personality updates.

Regulatory flashpoints

China’s Generative AI Management Measures (2024) now require companies to ensure chatbot safety, data security, and prevent addictive behavior.

Startups must now:

Localize sensitive content filtering

Add session time limits for minors

Disclose data collection practices

These rules could slow iteration but also boost consumer trust and international compliance potential.

Conclusion

AI companions are no longer a curiosity. In China, they’re rapidly becoming fixtures in bedrooms, classrooms, and care homes. As the world’s most emotionally complex consumer market scales this hybrid category, it’s setting standards the rest of the world may soon adopt.

Sources: ARK Invest (2024), Tencent Research Institute (2024), Shenzhen MoeFriend press release, Haivivi product data, Pop Mart Q1 2025 report, CASS Business School commentary, Kickstarter data, CES showcase coverage, Replika and Character.AI company reports