Apple and Huawei tied at 15% as China smartphone market fragments

Three consecutive quarters produce three different leaders as 68.4 million unit market contracts 0.6% year-over-year, compressing top five vendors into 600,000-unit band

Compressed top-five vendors into a 600,000-unit band across the first three quarters, with vivo’s 37 million units leading Huawei’s 35.8 million by just 120,000 units

Drove vivo’s high-end share from 11.4% to 16.9% in the 4,000-6,000 yuan segment during January-July 2025

Produced three leadership changes across three quarters, breaking the stability that characterized 2024’s 4% market recovery

Slashed Xiaomi’s share from 19% in Q1 to 15% in Q3 as government subsidy effects dissipated

Positioned Apple and Huawei in a statistical tie at 15-16% share, separated by less than one percentage point as iPhone 17 demand exceeded predecessor models

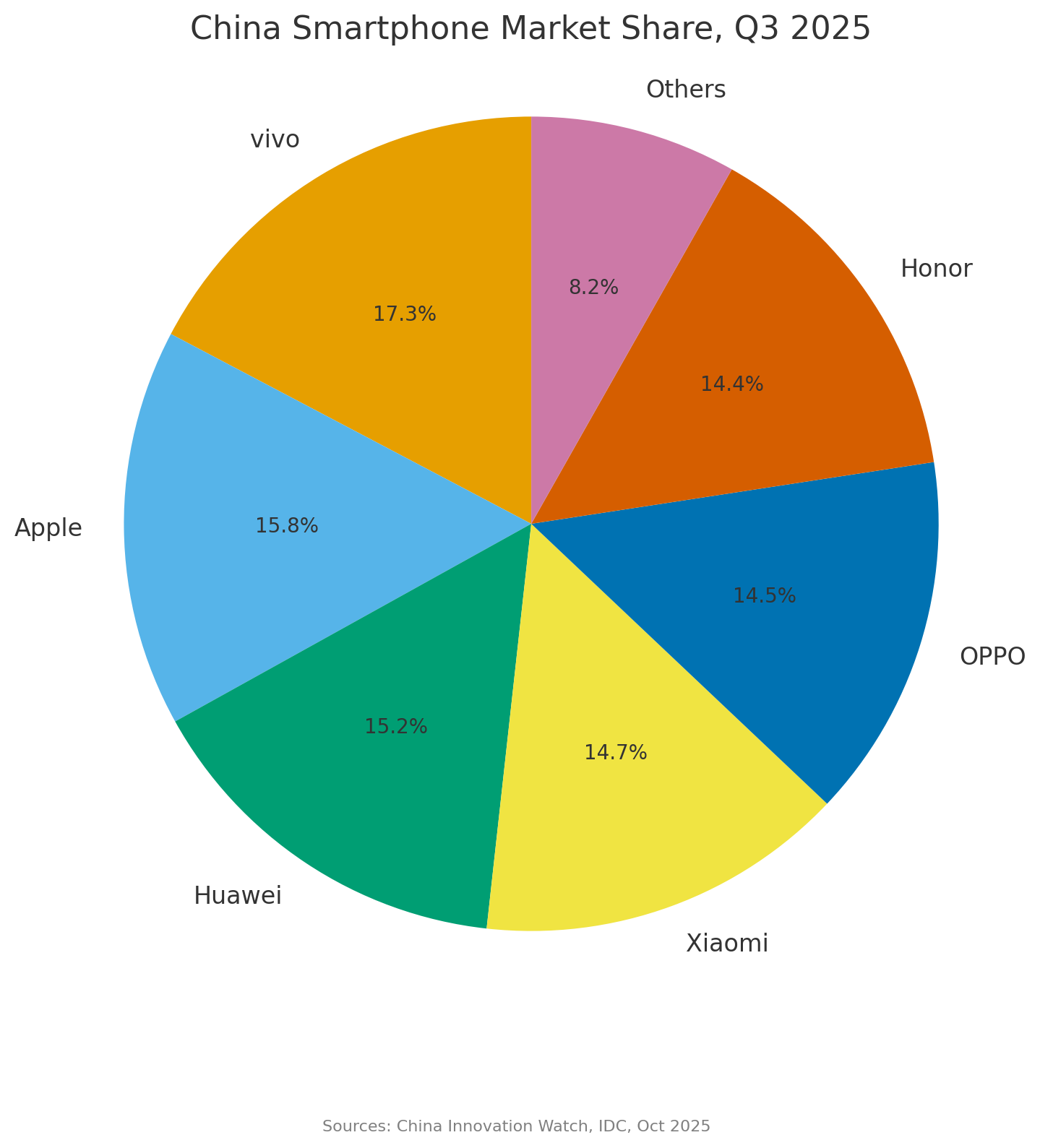

China’s smartphone market enters Q4 2025 with no clear leader. The third quarter delivered 68.4 million units, down 0.6% year-over-year, as vivo, Apple, and Huawei jostle for supremacy in a market where the gap between first and fifth place has collapsed to razor-thin margins.

Three quarters deliver three winners as stability collapses

The Chinese smartphone market produced a different leader in each of 2025’s first three quarters, marking a dramatic departure from 2024’s relative stability.

According to IDC China’s quarterly tracking report, vivo reclaimed first place in Q3 with 11.8 million units and 17.3% market share, despite shipments declining 7.8% year-over-year. The vendor’s channel network and product matrix proved sufficient to hold the top position even as volumes contracted.

Xiaomi led in Q1 with 19% share. Huawei returned to first place in Q2 after a four-year absence, reaching 18% share. By Q3, vivo had regained pole position. This quarterly rotation reflects what Omdia analysts describe as the market’s return to normalized rhythms after early-year government subsidy programs created temporary demand spikes.

The instability stems from China’s definitive transition to a replacement-cycle market. Growth disappeared. Competition now centers on capturing share from rivals rather than riding market expansion.

Every percentage point must be extracted from a competitor’s installed base, elevating the importance of channel efficiency, supply chain responsiveness, and promotional timing to unprecedented levels.

Apple and Huawei locked in premium segment duel

Apple and Huawei occupy second and third positions, separated by margins too narrow to call decisively.

Apple shipped 10.8 million units in Q3 for 15.8% share, up 0.6% year-over-year, according to IDC data. Huawei moved 10.4 million units for 15.2% share, with its year-over-year decline narrowing to 1.0%.

Both vendors operate within a one-percentage-point band, reflecting intense competition in China’s premium tier.

Apple’s Q3 performance marks a sharp reversal from its early-quarter position. Counterpoint data for the July-August period showed Apple at just 12% share, ranking sixth.

The iPhone 17 launch in September drove the rebound. Pre-orders exceeded iPhone 16 levels, according to IDC reporting.

Strategic adjustments amplified the impact: Apple positioned select iPhone 16 Pro variants, including the 128GB model, within government subsidy eligibility thresholds through tactical pricing, stimulating demand in price-sensitive segments.

Huawei’s Q3 share decline from Q2’s 18% reflects deliberate resource allocation toward ultra-premium products rather than volume maximization.

The company launched the Mate XTs foldable device at a 19,999 yuan starting price, prioritizing margin over units. This strategy delivered results in the 4,000-6,000 yuan segment, where Huawei commanded 34.3% share during January-July 2025, according to Counterpoint analysis—more than double the share of any domestic rival except Xiaomi.

Xiaomi’s subsidy-driven surge proves unsustainable

Xiaomi experienced 2025’s most dramatic share swing, plummeting from 19% in Q1 to 15% in Q3. The company shipped 10 million units in the third quarter for 14.7% share, down 1.7% year-over-year, landing in fourth place according to IDC data.

The trajectory reveals that Q1’s elevated performance represented a temporary spike driven by government purchase incentives rather than sustainable demand.

Year-over-year comparisons confirm Xiaomi’s Q3 share remained essentially flat against 2024 levels. The 15% range represents the company’s natural market position absent policy stimulus. The subsidy-amplified Q1 surge created an illusion of momentum that evaporated as support programs wound down.

Xiaomi’s challenge centers on product portfolio construction.

Keep reading with a 7-day free trial

Subscribe to China Innovation Watch to keep reading this post and get 7 days of free access to the full post archives.