How AI and Elderly Demographics Created China’s Most Profitable Micro-Drama Tier

Budget productions return 70% profitability. Premium content gambles on binary outcomes.

Budget micro-dramas (100K-300K RMB) achieve 70% profitability rates through portfolio approach vs. premium tier’s hit-or-miss binary outcomes

310M Chinese seniors (22% of population) possess time-rich, ad-tolerant, quality-agnostic characteristics that eliminate cost-to-quality correlation

AI script generation enables 10-20 person crews to produce 120+ titles annually vs. traditional 12 titles per year

Platform subsidies persist because budget content solves inventory scarcity in Tier 3-5 cities where premium content economics fail

Southeast Asia validation shows 7x CPM premium over domestic rates, positioning this as export model beyond China

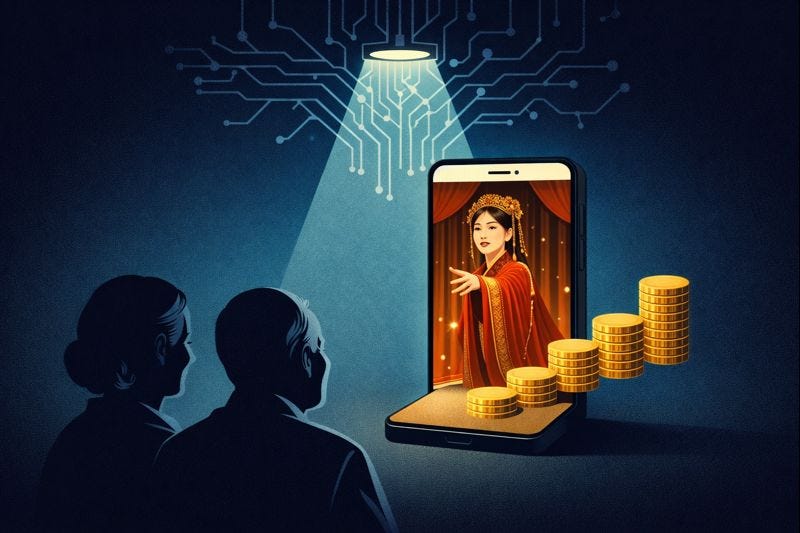

China’s micro-drama industry entered 2025 facing a critical inflection point. The market reached 50.4B RMB according to DataEye. Premium productions escalated costs while platform guarantee payments dropped 60-80% starting September 2024. This forced mid-tier producers to confront whether high production values generate superior returns.

The answer challenges conventional assumptions.

The Profitability Paradox: Why Cheaper Content Makes More Money

Budget micro-drama producers discovered that 100K-300K RMB productions generate better risk-adjusted returns than 500K-1M premium content.

The math reveals the advantage. Premium tier operates as binary gamble. 500K-1M investment. Approximately 30% success rate. Total loss on failures.

Budget tier functions as portfolio strategy. 100K-300K per title. 70% achieve breakeven or profitability. 20-50% margins per successful title.

Dafang Hulian, a Zhengzhou-based production company with 100+ staff, experienced this directly. The company invested 600K RMB in a premium drama launched May 2025. Final return reached only 100K RMB, representing 83% loss.

Li Runzhe, commercial manager at Dafang Hulian, explained the shift. “We now invest in 10 dramas at 100k RMB each instead of gambling 500-600k RMB on one premium drama.”

The portfolio approach transforms economics. Ten budget productions totaling 1M RMB typically see seven titles return profit. Combined returns deliver 20-30% overall profitability in conservative scenarios. Returns reach 100% when multiple titles perform well. Single premium dramas offer higher ceiling but catastrophic floor.

Platform guarantee reductions accelerated this realization. Through 2024, platforms guaranteed up to 500K RMB for content. By September 2024, guarantees dropped dramatically.

“The maximum guarantee fell to around 200K RMB,” Li noted. “More risk transferred to producers.”

Investment psychology shifted accordingly. “Investors contributing 200-300k RMB for downmarket content view it differently than 500-600k RMB premium bets,” Li observed. Budget tier enables measured experimentation. Premium tier demands conviction.

The Audience Arbitrage: Why 310M Seniors Make Budget Content Profitable

The profitability paradox exists due to specific audience characteristics that eliminate the cost-to-quality correlation governing traditional media economics.

China’s elderly population reached 310M people aged 60+ by end of 2024, representing 22% of total populationaccording to National Health Commission data. This demographic will exceed 400M by 2035, adding 10M+ annually.

Three behavioral traits create structural profitability:

Time availability. Elderly viewers possess significantly higher daily viewing hours than younger demographics. Retirement and reduced work obligations translate to consumption capacity.

Ad tolerance. This audience demonstrates willingness to watch advertisements for free content. Younger viewers employ ad-blocking technology or pay for ad-free experiences. Elderly users complete ad views at substantially higher rates.

Piracy resistance. Lower technical literacy around VPN usage and torrent access means elderly viewers primarily consume content through official channels. Premium content loses substantial revenue to piracy. Budget content on official platforms captures full monetization.

Quality agnosticism. Most critically, elderly viewers prioritize complete narrative arcs and direct emotional payoffs over production sophistication. “They don’t require television or film-level narrative structure,” Zhang Lai, founder of Zhejiang-based Xinnengliang Fenghua Short Drama Dream Factory, explained. “Emotion delivered straightforwardly, story told completely, that meets standards.”

Blue-collar workers constitute the secondary audience segment. Security guards, delivery drivers, domestic workers, construction laborers share similar characteristics. Fragmented attention windows. Preference for accessible content. Limited willingness to pay premium prices.

Popular themes reflect audience preferences. Rural life dramas, mother-in-law conflicts, village suspense, middle-aged CEO stories dominate viewership. Content difficulty drops substantially from premium requirements.

This creates defensive moat. Premium producers cannot profitably serve these viewers. Their cost structure requires either $5+ CPM advertising rates or $0.50+ per episode direct payment. Elderly audiences in Tier 3-5 cities generate $2-3 CPMs and near-zero direct payment willingness.

Premium producers would need to cut costs 60% to compete. That reduction would eliminate their production quality advantage entirely. Budget producers already operate at this cost level. This makes their position structurally unassailable within this demographic.

The Market Mechanism: How Mid-Tier Collapse Forced Business Model Discovery

Three production companies arrived at identical conclusions within six months. This signals structural opportunity, not tactical luck.

Dafang Hulian shifted strategy in late 2024 after the premium drama loss. For 2026, the company plans allocating two-thirds of capital to downmarket productions focusing on original IP and copyright ownership.

Gangzi (pseudonym) co-founded Henan Yunye Tingfeng Film Industry in September 2024, launching directly into budget production. “Premium female-targeted content requires expensive cast. Premium male-targeted content demands high-quality script development over two to three months,” Gangzi noted. Both paths require capital beyond mid-tier capabilities.

Zhang Lai established Xinnengliang Fenghua Short Drama Dream Factory in Zhejiang in December 2024, also targeting budget tier exclusively.

Geographic distribution confirms broad-based movement. Production companies span Zhengzhou in Henan and various cities across Zhejiang. This isn’t isolated regional phenomenon.

Head consolidation drives mid-tier exodus. Tinghuadao captured 4 of top 10 positions on DataEye Red Fruit Hot Rankings for November. S-tier premium productions reached 1.5-3M RMB per title in 2025. Hit titles like “Shengxia Fendela” and “Jiali Jiawai 2” exceeded even that range.