China payment markets overview 2025

Cross-border payment growth slows to 2.9% while AI adoption reshapes China’s domestic transaction landscape.

Cross-border B2B payment volume growth slowed to just 2.89% in Jan–May 2025, down from 28.05% in 2024.

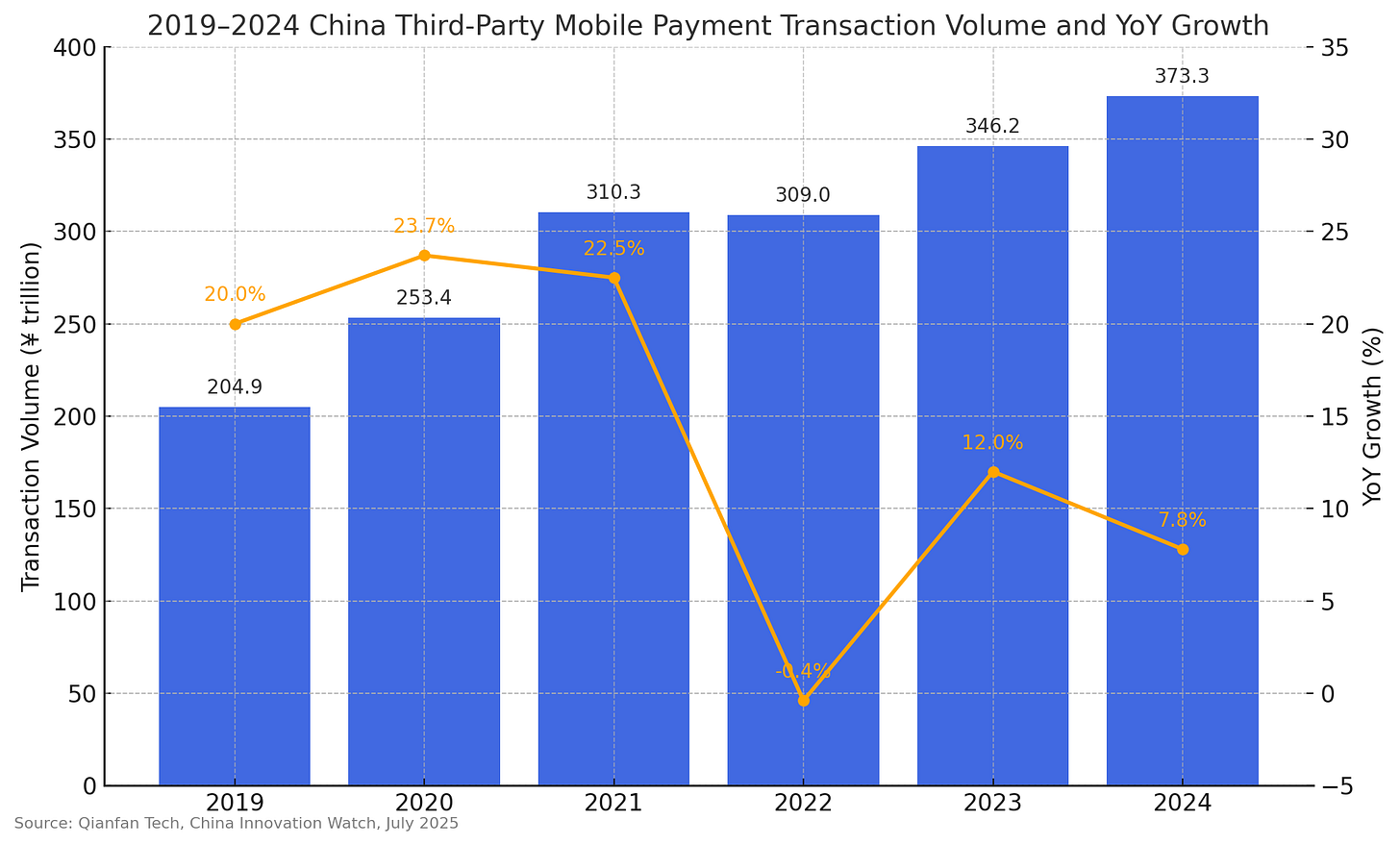

Domestic mobile payment market expanded 7.8% YoY in 2024 to ¥373.3 trillion, rebounding from 2022’s contraction.

Nine major payment providers, including Alipay and UnionPay Commerce, adopted DeepSeek LLMs by mid-2025.

After aggressive pandemic-era adoption, China’s payment ecosystem entered a phase of moderated, differentiated growth.

Since late 2023, stimulus-driven consumer activity and localized AI integration have shaped the pace and structure of payment innovation. Institutions are navigating macro pressures while leveraging AI and infrastructure advances to sustain relevance. The State Administration for Market Regulation continues to monitor platform behavior and fintech expansion.

From tech pilots to production-grade rollouts

Firms like Alipay and UnionPay Commerce are spearheading full-stack integration, using DeepSeek LLMs to lead AI R&D across multiple business lines.

Others like Tenpay and Wing Payment are applying LLMs to specific tasks like content generation, data analysis, and intelligent customer segmentation, often co-developing tools with third-party vendors.

The most common front-office applications include AI-enhanced customer interaction and fraud detection. LLMs are being trained to understand payment context, identify anomalous behavior, and automate real-time risk flagging.

Meanwhile, smart customer service bots now leverage natural language comprehension to resolve queries and offer personalized financial advice.

Mobile payment market grows 7.8% in 2024

China’s third-party mobile payment market reached ¥373.3 trillion in total transaction volume in 2024, up 7.8% year-over-year.

The growth was fueled by a new round of consumer subsidies and renewed capital inflows into the real economy, helping maintain strong baseline growth in mobile payment services.

Keep reading with a 7-day free trial

Subscribe to China Innovation Watch to keep reading this post and get 7 days of free access to the full post archives.