China digital landscape in 12 charts

E-commerce saturation, mini program breakthroughs, and shifting engagement patterns define China’s digital economy in 2025.

E-commerce dominates: General e-commerce apps lead with 1.1 billion monthly active users (MAUs), dwarfing other shopping categories.

Travel rebounds: Online travel platforms generated ¥169.7B in January 2025, though values softened to ¥145.3B by June.

Gaming shifts: MOBA remains strong at 23.6% share of usage, but shooter games surged from 12% to 19.2% YoY.

Video ecosystem bifurcates: Tencent Video dominates MAU with 363.3M users, but Bilibili leads DAU with 69.9M.

Advertising stabilizes: China’s internet ad market reached ¥200.7B in Q2 2025, up 6.8% YoY after earlier volatility.

Tech titans’ reach: Tencent and Alibaba each command over 1.2B unique mobile internet users, cementing market leadership.

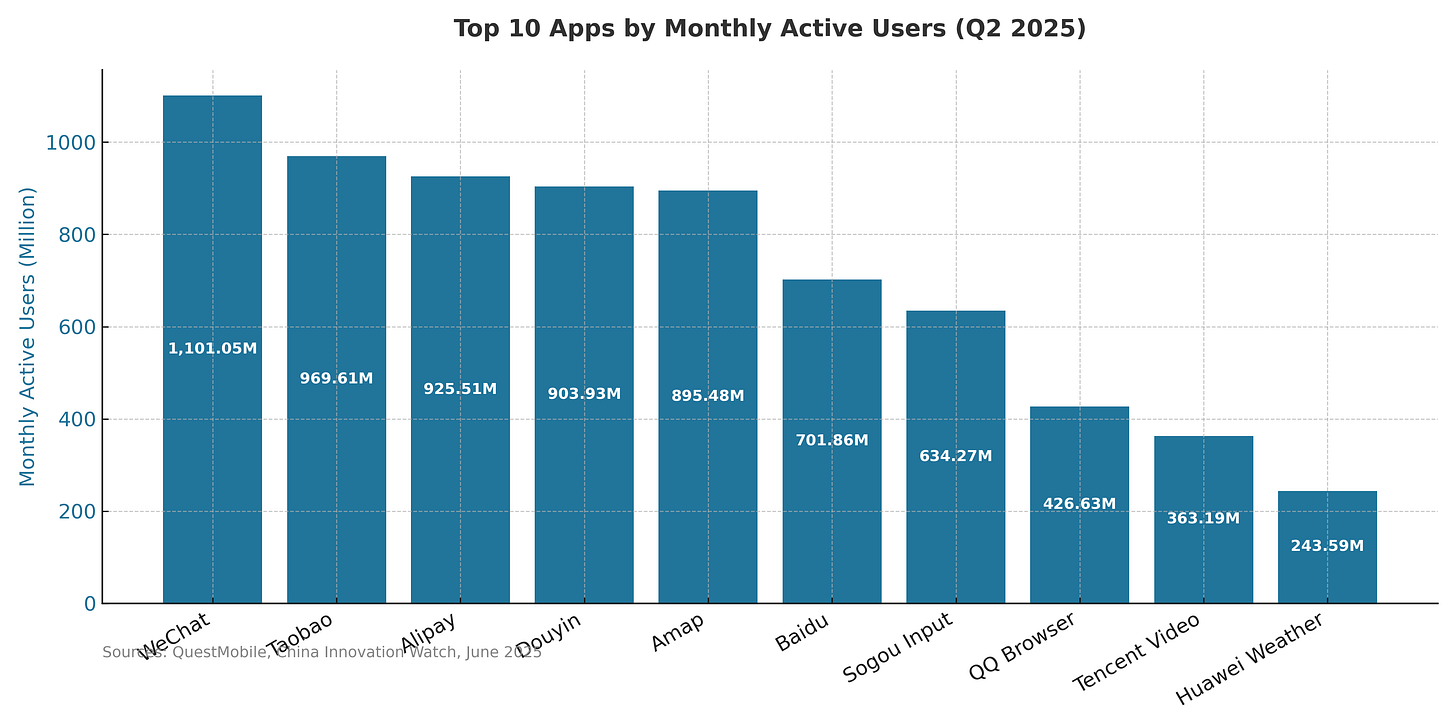

Top Apps in Select Categories

The competitive landscape at the very top remains dominated by the heavyweights of China’s digital economy.

WeChat retained its crown with 1.1 billion MAUs, acting as the country’s “super app.” Taobao (970 million) and Alipay (926 million) underscored the enduring dominance of e-commerce and digital payments, while Douyin (904 million) consolidated its position as the leading short video platform.

Meanwhile, Amap (895 million) showed the critical role of location-based services in daily life, and Sogou Input (634 million) highlighted how even “utility” apps can command massive reach in China.

The data reinforces how the digital ecosystem is anchored by apps that serve both lifestyle and transactional needs.

CIW Premium subscribers can get the download link of additional mobile apps statistics in downloadable spreadsheet here.

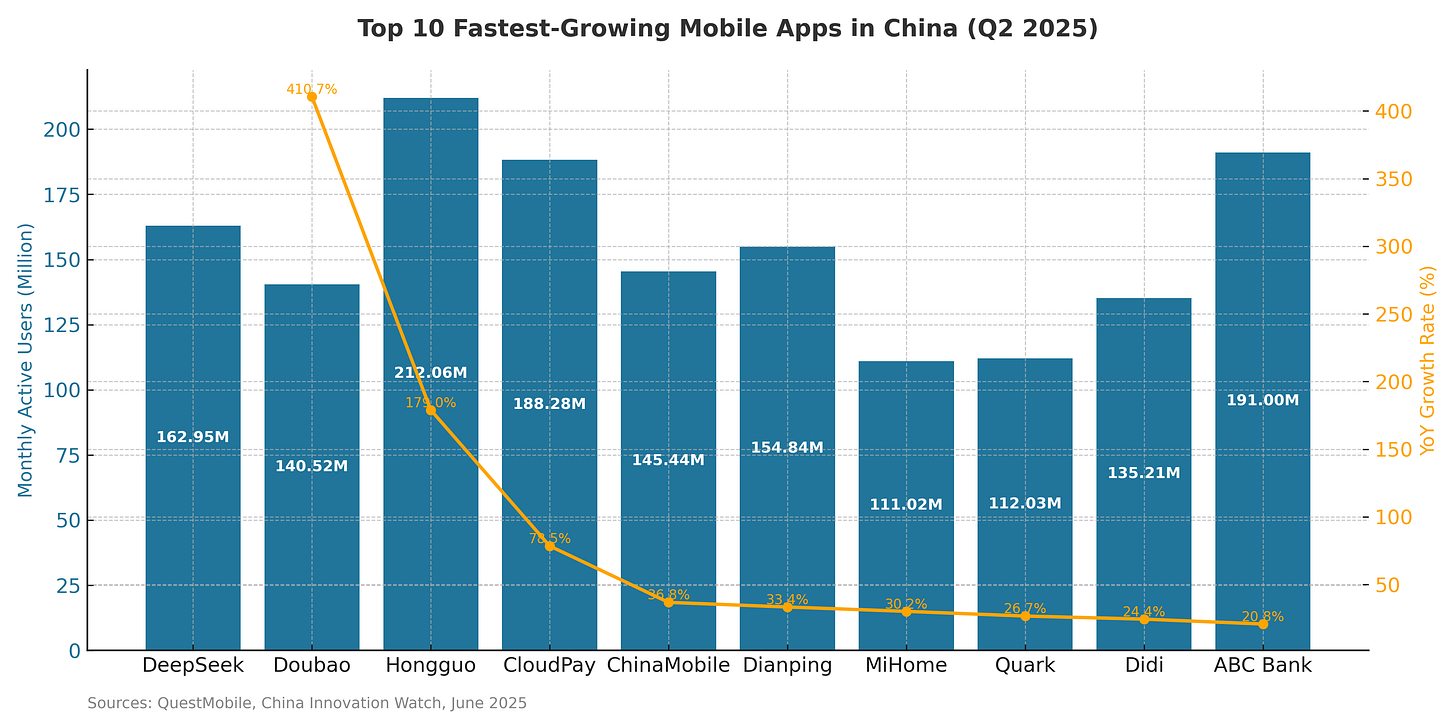

Fastest-Growing Mobile Apps in China

China’s mobile internet continues to produce breakout stars, with new apps climbing user charts at an unprecedented pace. The standout is DeepSeek, an AI-powered app that amassed 162.9 million monthly active users (MAUs) within just one quarter of launch, reflecting the country’s surging appetite for AI-driven services.

Hot on its heels, Doubao, another AI app from ByteDance, grew by an astonishing 410.7% year-on-year, while Hongguo and CloudPay posted strong gains with 212 million and 188 million MAUs, respectively. Even traditional service providers like ABC Bank saw a digital boost, registering 191 million MAUs.

This signals two clear shifts: AI applications are scaling rapidly, and established service players are finding new traction by digitizing everyday services.

Mobile Shopping: Scale Meets Segmentation

Keep reading with a 7-day free trial

Subscribe to China Innovation Watch to keep reading this post and get 7 days of free access to the full post archives.