China internet in 2025: scale, shifts, and the battle for user time

China’s 1.123 billion internet users spend nearly eight hours a day online, with rural, senior, and multi-service super-app segments driving the next wave of competition.

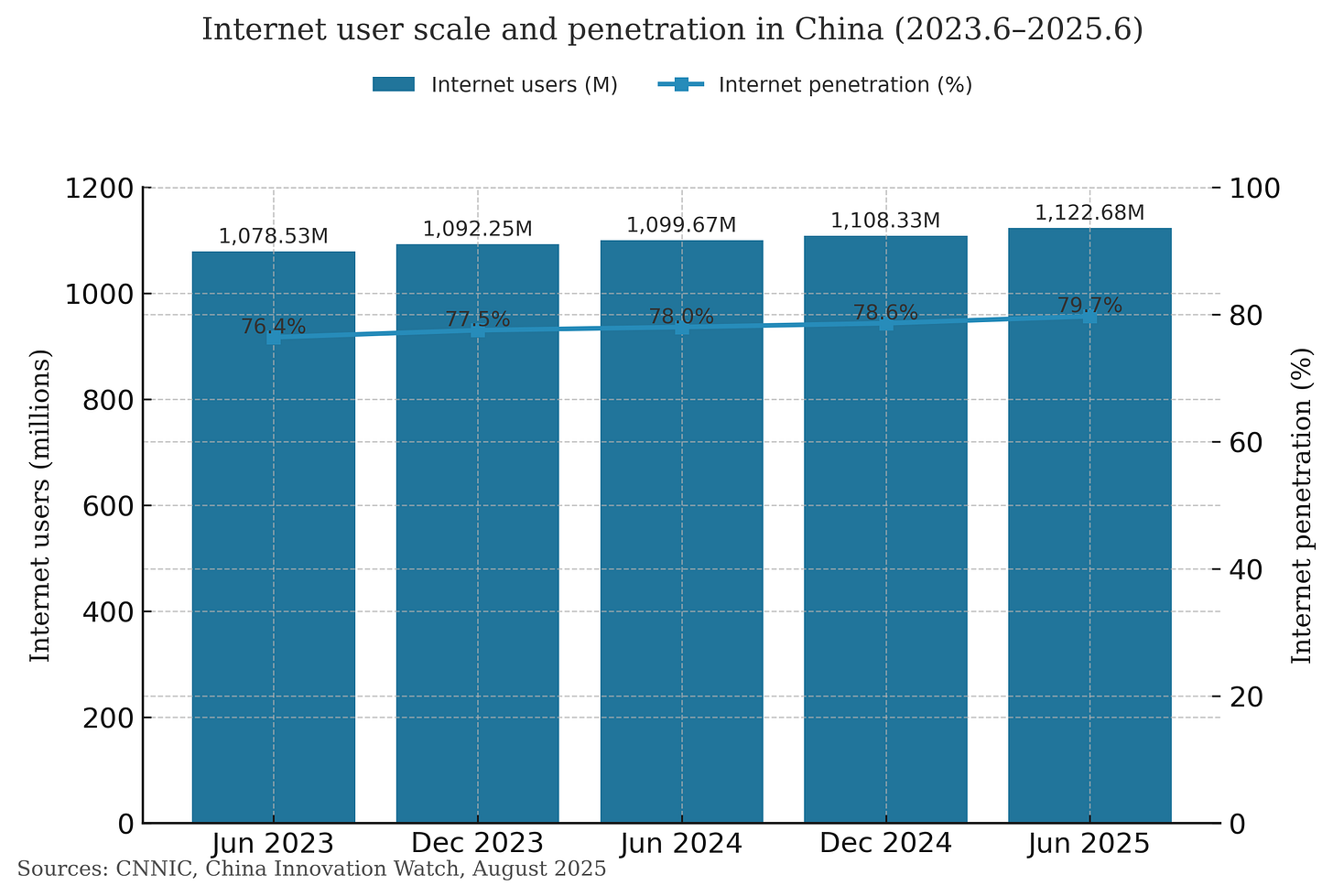

China’s internet user base reached 1.123 billion by June 2025, adding 14.36 million in six months, for a penetration rate of 79.7%

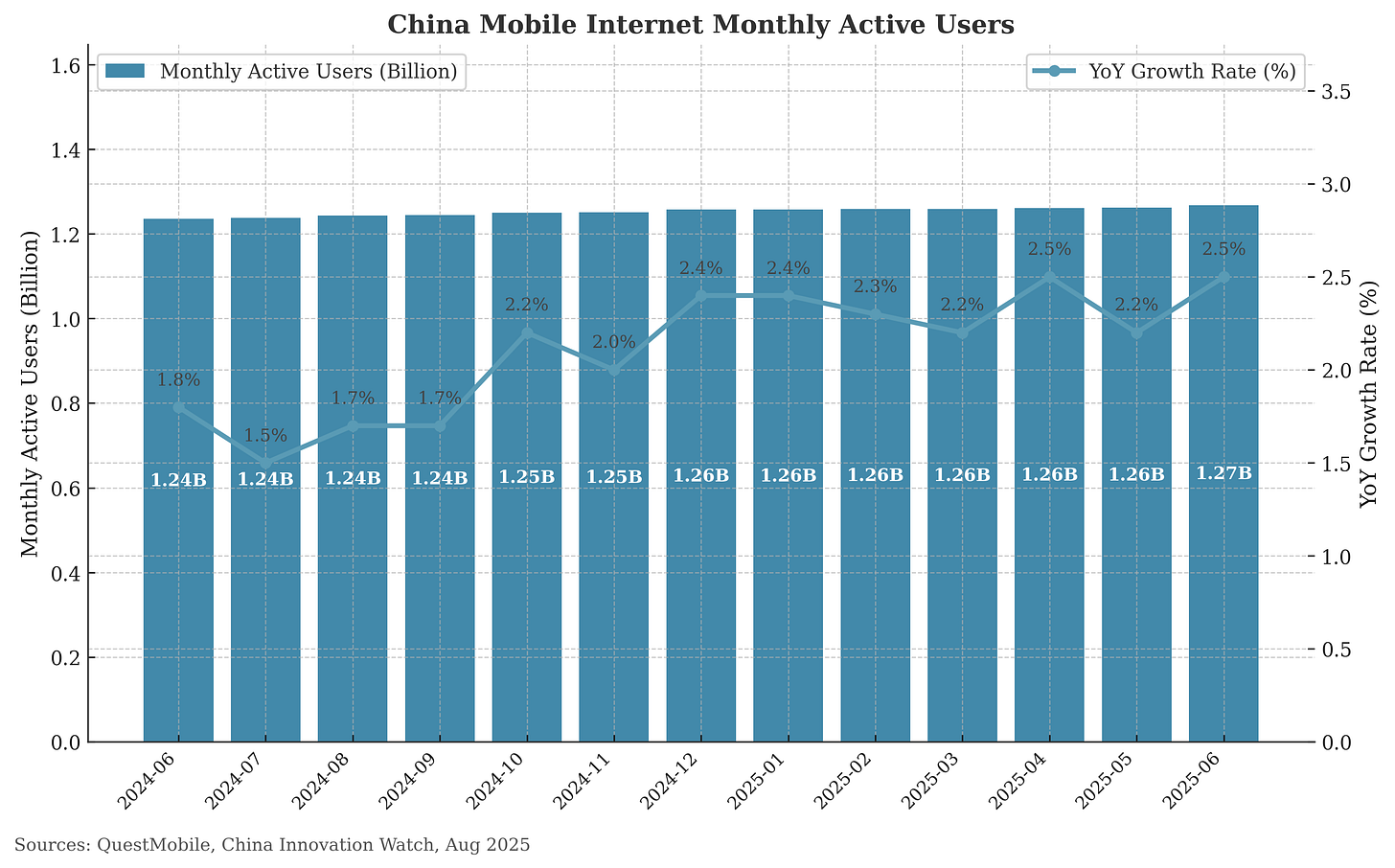

Mobile internet monthly active users (MAUs) climbed to 1.267 billion, up 2.5% year-on-year, with daily average usage hitting 7.97 hours and 117.9 sessions

Rural internet penetration rose to 69.2%, narrowing the urban–rural gap, as smaller cities and counties became new growth engines

Short video platforms reached 1.068 billion users, while micro-drama audiences grew to 626 million, reshaping content monetization

E-commerce MAUs surged during the 618 festival, with JD.com’s daily actives up 33.2% and Meituan’s up 18.2% in June

Over the past 18 months, China’s digital landscape has transitioned from breakneck user acquisition to competing for depth of engagement. National broadband and 5G coverage targets have been met, with over 90% of administrative villages covered by 5G (CNNIC, June 2025).

At the same time, macroeconomic recovery and targeted consumption stimulus — including subsidies for electronics and vehicles — have bolstered online retail and travel.

QuestMobile data shows that by mid-2025, mobile internet's monthly active users stood at 1.267 billion, up 2.5% year-on-year. Average daily use grew 7.8% to 7.97 hours, while sessions rose 2.6% to 117.9 per day. This signals that even in a saturated market, users are giving more of their attention — and wallets — to digital channels.

Paid subscribers can get additional insights on China digital landscape here.

Demographics and Usage Patterns

Scale and penetration

By June 2025, China had 1.123 billion internet users, up 14.36 million from December 2024, representing 79.7% of the population (CNNIC, June 2025). Mobile internet users totaled 1.116 billion, or 99.4% of all netizens.

QuestMobile’s broader MAU definition captures 1.267 billion active mobile internet users, reflecting overlap across multiple devices and accounts.

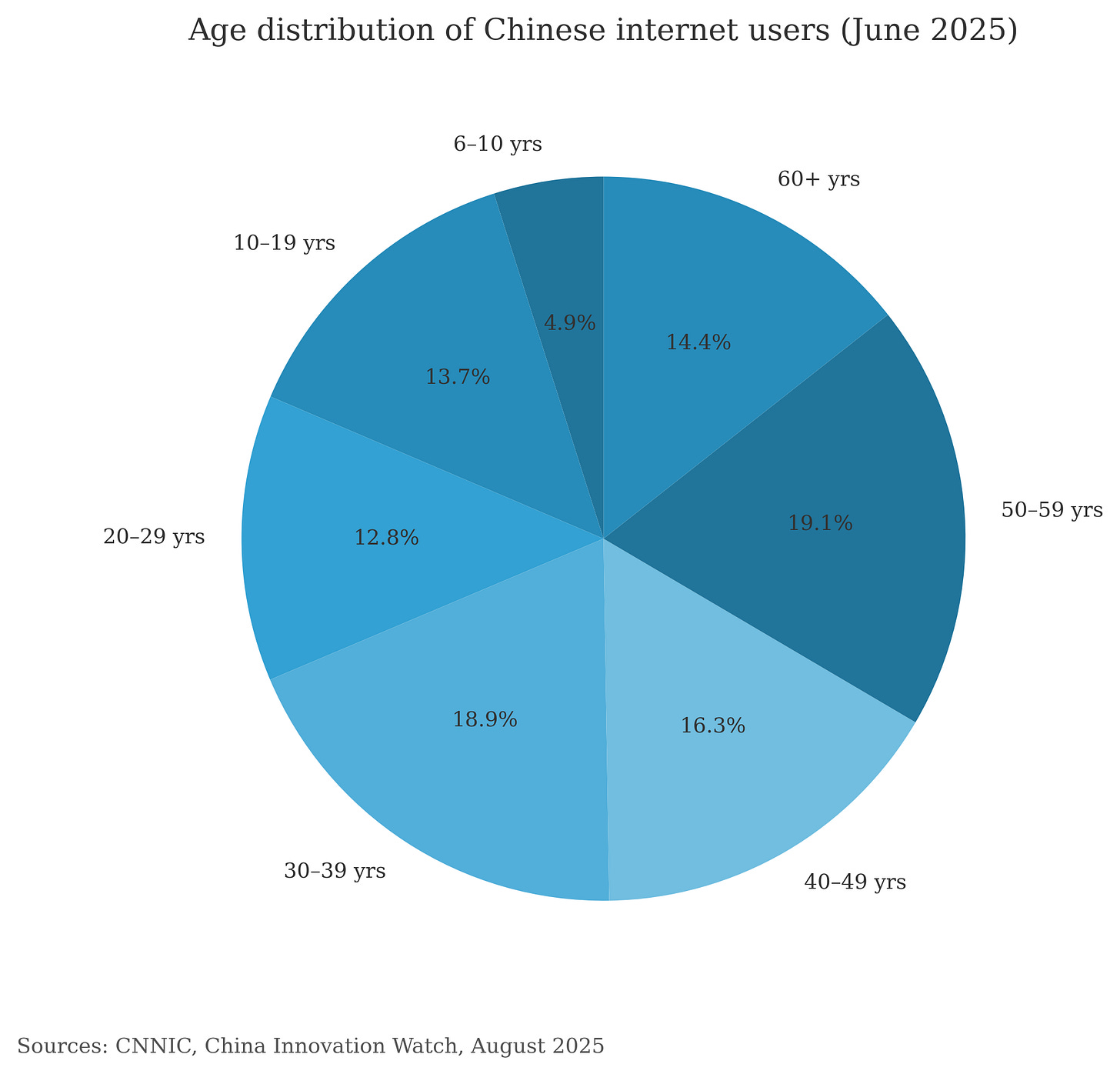

Gender and age

Chinese netizens were 50.4% male and 49.6% female. The population skews older than in previous years: 33.5% are aged 50+, and 14.5% are 60 or above (CNNIC, June 2025). The largest single age cohort is 30–39 at 18.9%.

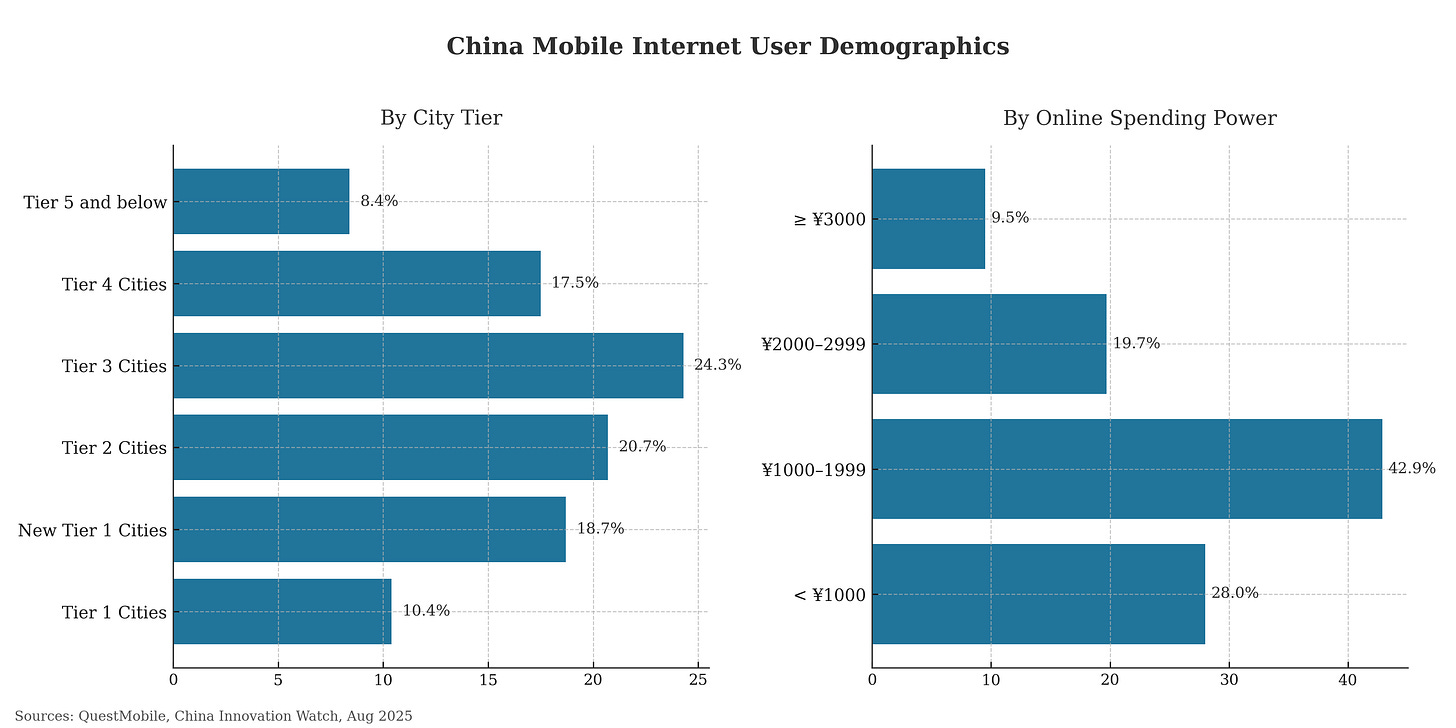

Urban–rural split

Urban users account for 71.3% of netizens; rural users make up 28.7%, with rural penetration at 69.2%, up 1.9 percentage points from December 2024 (CNNIC, June 2025).

Rural adoption is being driven by fibre rollouts, device subsidies, and local e-commerce service stations.

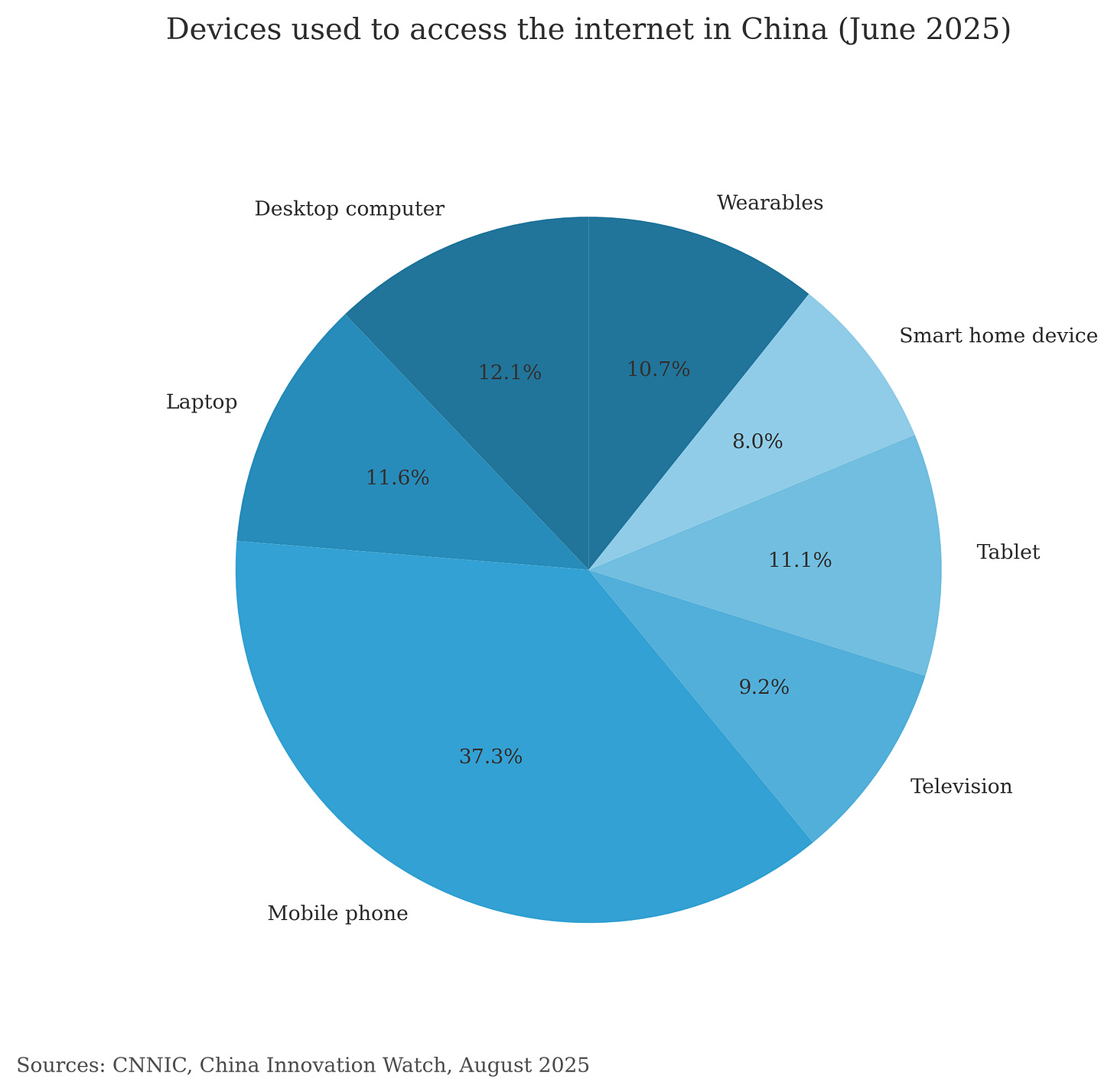

Devices

Beyond mobile, 32.3% use desktop PCs, 30.9% laptops, 29.6% tablets, 24.5% smart TVs, 21.4% smart home devices, and 28.6% wearables (CNNIC, June 2025).

Wearable usage grew by nearly 57 million in six months, fuelled by AI-integrated fitness and health devices.

Time online

CNNIC reports average weekly use at 30.6 hours, up 1.9 hours from December 2024. QuestMobile’s daily measurement puts the average at 7.97 hours with 117.9 sessions, indicating more frequent micro-interactions across apps (QuestMobile, June 2025).

Search Engines

The number of China's search engine users reached 777 million in June 2025, 69.2% of netizens (CNNIC, June 2025).

QuestMobile highlights search as the year’s "black horse" growth sector, driven by the integration of AI reasoning models such as DeepSeek-R1.

Native AI search apps like ByteDance’s Doubao and Tencent Yuanbao ranked among the top user growth apps in H1 2025, while AI search plugins embedded in super-apps captured significant share from standalone search apps.

For platforms, the battle is shifting from keyword accuracy to multi-modal AI capabilities — integrating voice, image, and video search — with Tencent and Baidu leveraging their content ecosystems, and Douyin embedding search into its video and commerce flows.

Social Media

Instant Messaging

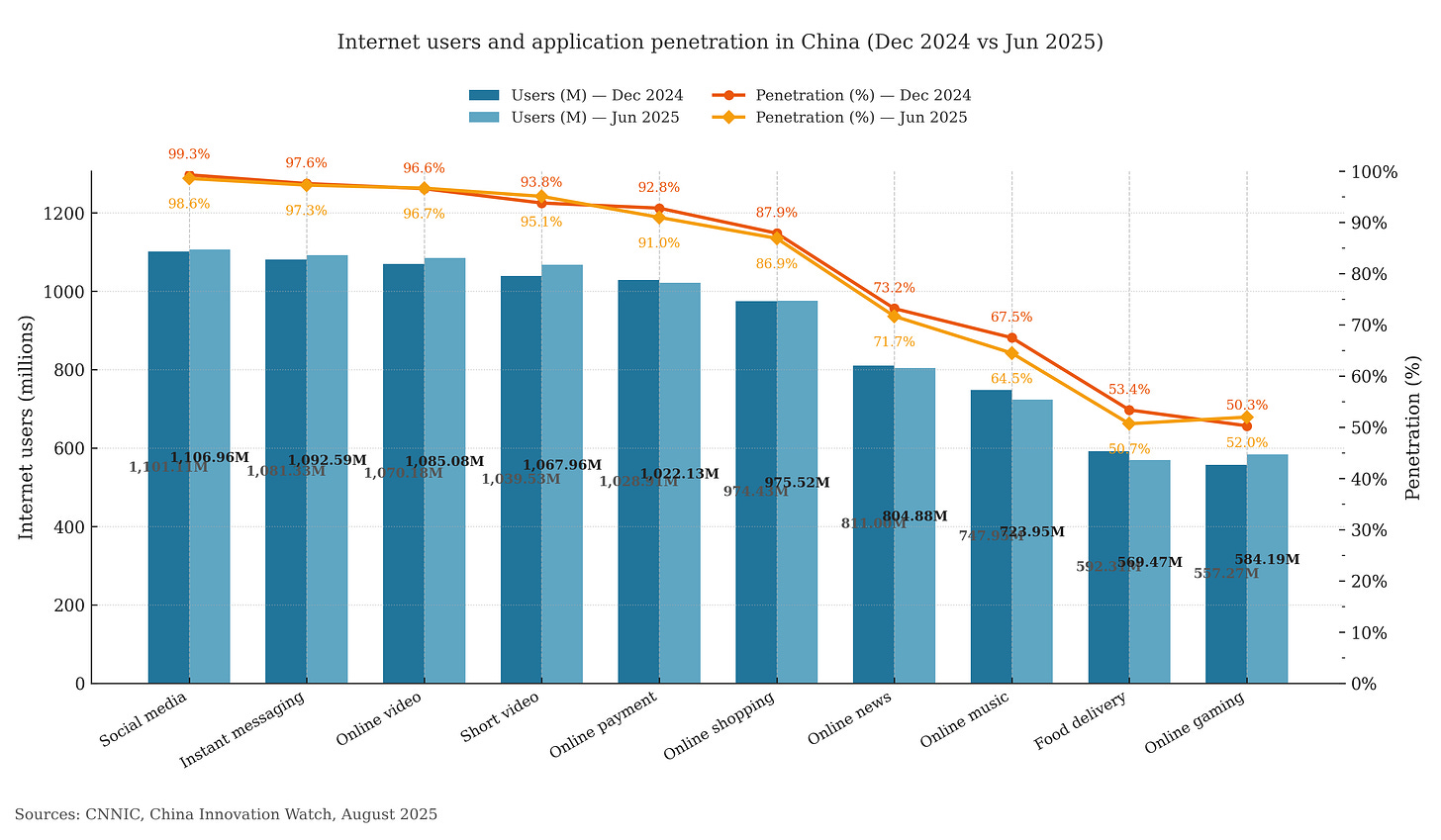

Instant messaging users reached 1.093 billion, or 97.3% of netizens (CNNIC, June 2025). WeChat continues to dominate, layering AI assistants and commerce integrations.

QuestMobile notes Tencent's strategy of embedding messaging into a "social super-app" that also covers payments, entertainment, and work collaboration.

Enterprise communication is also a growth area: DingTalk’s AI-powered office tools and Tencent Meeting’s transcription and summarisation features have increased adoption, with Tencent Meeting’s monthly active users doubling year-on-year to 15 million (QuestMobile, June 2025).

Social Networking

Social network users numbered 1.107 billion (98.6% penetration) in June 2025 (CNNIC).

Content focus varies: 55% follow social news, 39.3% track livelihood topics like employment and education, and 31.4% follow foreign news.

QuestMobile reports further concentration of influence on Douyin and Kuaishou. Douyin’s KOL ecosystem skews toward film commentary, micro-dramas, and food content, making up 60% of top creator posts.

Viral moments still break through — the mathematician "Wei Dongyi" attracted 115 million unique viewers in June 2025 with a single short video.

Digital Economy

Online Payment

Online payment users hit 1.022 billion (91.0% penetration) by mid-2025 (CNNIC).

Mobile payments dominate retail and services, while the People’s Bank of China advances digital RMB internationalisation via a new Shanghai-based international operations centre.

QuestMobile notes UnionPay’s Cloud QuickPass MAUs rose nearly 80% YoY to 188 million, leveraging e-commerce partnerships for subsidy redemption.

Alipay is pivoting toward becoming a lifestyle super-app, integrating short video and casual games to increase dwell time.

Online Shopping

Online shopping users totalled 976 million (86.9%) in June 2025 (CNNIC).

Consumption trends include AI-assisted shopping, “emotional spending” on IP merchandise and blind boxes, and strong performance in home appliances and electronics.

QuestMobile data shows the 618 mid-year shopping festival driving surges: JD.com’s daily actives up 33.2%, Meituan up 18.2%, and Taobao up 7.3% in June.

Livestream commerce has become core — in some categories, brand-run livestreams account for over 60% of sales. China livestream icon Luo Yonghao introduces dual digital avatars on Baidu, delivering over ¥55 million in sales and reshaping AI+livestreaming innovation.

Instant retail is also gaining, with local electronics purchases fulfilled within hours.

Food Delivery

Food delivery users numbered 569 million (50.7% penetration) (CNNIC). Platforms are expanding supply through partnerships and technology: Meituan’s drone deliveries now operate in Shenzhen, Beijing, Shanghai, and Dubai.

QuestMobile notes JD.com’s entry into food delivery with a zero-commission model for merchants, intensifying competition with Meituan and Ele.me.

Internet Healthcare

Internet healthcare users reached 393 million (35.0%) (CNNIC). Policy measures include national drug traceability codes, while 5G-enabled telemedicine expands access to underserved regions.

Online Education

Online education users stood at 293 million (26.1%) (CNNIC). Rural usage is 17.4%, or 55.82 million users, reflecting targeted efforts to close the education gap.

Platforms are adding AI features for personalised learning and integrating short-form content to attract younger audiences (QuestMobile, June 2025).

Entertainment

Online Video

Online video users reached 1.085 billion (96.7%) by mid-2025 (CNNIC), with short video at 1.068 billion (95.1%) and short-drama at 626 million (55.8%).

QuestMobile reports further traffic concentration in Douyin and Kuaishou.

Douyin’s app traffic hit 900 million MAUs, with KOL posts increasingly focused on short dramas.

Long video platforms like Youku and Bilibili are leveraging hit dramas — e.g., Canghai Chuan boosted Youku’s usage metrics significantly — while also producing short dramas to compete for user time.

Gaming

Gaming users numbered 584 million (52.0%) in June 2025 (CNNIC), with female players making up 48%, up 3.1 percentage points from 2024.

QuestMobile notes MOBA remains the top genre by playtime, but demand is rising for shorter-session games. Mini-games on WeChat now number 20 titles with 10 million+ users, exceeding the count for top native mobile games.

Travel and Mobility

Online Travel

Online travel booking users totalled 514 million (45.8%) (CNNIC). Growth is driven by domestic tourism and easing entry restrictions for foreign visitors.

QuestMobile reports online travel platform GMV reached RMB 145.33 billion in H1 2025, with user counts up 4.4% YoY to 156 million for the OTA sector.

Ctrip, Meituan, and JD.com now compete directly in “flight+hotel+local” bundles, with overlapping user bases growing 20.4% YoY to 65.21 million. AI trip planners and AR-enhanced tourism content are emerging differentiators.

Mobility

Ride-hailing users numbered 511 million (45.6%) (CNNIC).

Platforms are diversifying into intercity and charter services, as well as pet-friendly travel. QuestMobile notes Gaode Dache’s MAUs grew 31% YoY to 54.19 million, with stronger adoption in lower-tier cities.

Implications

For business leaders, the slowing growth in overall penetration means success will depend on identifying and serving the fastest-growing segments — notably rural, senior, and multi-platform super-app users.

For investors, mature verticals like messaging and short video may face monetisation ceilings, but newer models in instant retail, livestream commerce, and integrated travel services still show double-digit growth potential.

For global tech and media, China’s near-total mobile saturation makes it an ideal test bed for multi-modal AI search, short-form commerce integration, and “super-app” service bundling. But regulatory requirements for algorithm transparency and content governance demand localisation and compliance readiness.

Conclusion

China’s internet in mid-2025 is vast, mobile-first, and increasingly shaped by demographic diversity.

While user growth is slowing in absolute terms, engagement depth is rising, platform competition is intensifying, and AI is being woven into search, commerce, and entertainment.

For global players, the opportunities lie less in chasing raw scale, and more in adapting to the country’s evolving mix of users, devices, and integrated digital services.

Sources: China Internet Network Information Center (CNNIC), 56th Statistical Report on China’s Internet Development, June 2025; QuestMobile, July 2025; company filings; media reports.

Brilliant analyses and reporting - as always.

Interesting to see the rural areas growing -aided maybe by the increased 5g and WiFi 7 roll outs?