Tencent rides AI surge to double-digit profit growth

AI-driven games and marketing push Tencent’s Q2 revenue to RMB184.5 billion, with international gaming up 35% YoY.

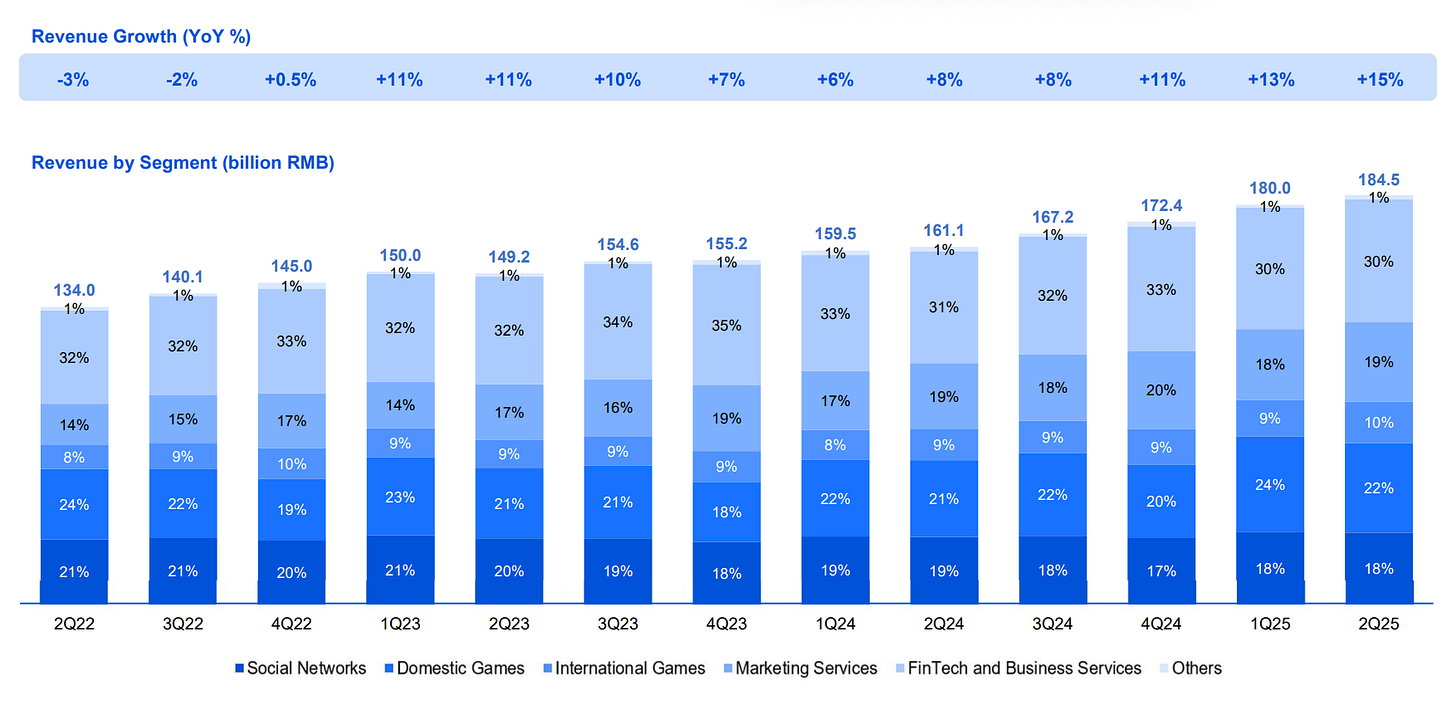

Lifts quarterly revenue 15% year-on-year to RMB184.5 billion in Q2 2025, driven by double-digit growth in games, marketing services, and fintech.

International gaming surges 35% YoY, led by Supercell’s titles, PUBG Mobile, and the launch of Dune: Awakening.

AI integration accelerates product performance—from ad targeting and game content creation to customer service and 3D asset generation.

Marketing services revenue climbs 20% YoY, with Weixin Search ads up ~60% as closed-loop ecosystems deepen.

Free cash flow rises to RMB43 billion, while CAPEX jumps 119% YoY to support cloud, AI, and gaming infrastructure.

Tencent Holdings Limited, China’s largest internet and technology company by market capitalization, entered the second half of 2025 with momentum. The June-quarter results, announced on 13 August 2025, show a sharp rebound across core segments, underpinned by AI-driven enhancements in gaming, marketing, and enterprise cloud services. The gains come amid a more supportive domestic consumption environment and intensifying global competition in digital entertainment, fintech, and cloud computing.

Domestic games anchor engagement

Tencent’s domestic games revenue climbed 17% YoY to RMB40.4 billion in Q2 2025, with average daily active users (DAUs) in the segment up more than 30%.

The breakout hit Delta Force (a first-person shooter released in late 2024) achieved over 20 million monthly average DAUs by July and ranked among the top three industry-wide titles by gross receipts in China during that month.

Legacy franchises such as Honour of Kings, Peacekeeper Elite, and VALORANT also expanded their user bases through new features and eSports events.

AI is increasingly central to Tencent’s game development. According to management, AI accelerates content production, enables more realistic non-player characters (NPCs), and powers targeted marketing campaigns for user acquisition and retention.

These capabilities shorten the update cycle and extend player lifetime value—key levers in sustaining long-term monetization.

International games outperform

International games posted 35% YoY growth to RMB18.8 billion. Supercell’s Clash Royale saw a seven-year high in monthly gross receipts after more frequent content updates, reward system optimization, and expanded community events.

PUBG Mobile hit record receipts in April, driven by user-generated content in its World of Wonder sandbox and themed in-game events.

The June launch of Dune: Awakening, an open-world survival game from subsidiary Funcom, topped the Steam pay-to-own revenue chart worldwide during its debut week.

The success highlights Tencent’s ability to leverage global IP and cross-studio development pipelines, positioning it against rivals like NetEase and Sony in the premium PC and console space.

Marketing services ride AI wave

Marketing services revenue surged 20% YoY to RMB35.8 billion, driven by large-scale deployment of Tencent’s upgraded advertising foundation model.

This model improves ad creative generation, placement accuracy, and performance analytics—lifting click-through rates (CTR) and conversion rates across platforms.

Weixin (WeChat) ecosystem properties led the gains:

Video Accounts marketing rose ~50% YoY as merchants drove traffic to live streams and Mini Shops.

Mini Programs marketing also grew ~50% YoY, benefiting from closed-loop attribution and high ROI for mini games and mini dramas.

WeChat Search ads climbed ~60% YoY, aided by large language model (LLM)-enhanced understanding of product catalogs and user intent.

This adtech modernization aligns Tencent with global peers like Meta and Google, which are similarly embedding generative AI into their advertising stacks.

FinTech and business services steady

FinTech and business services revenue advanced 10% YoY to RMB55.5 billion. FinTech gains were fueled by a rebound in commercial payment volumes, particularly in offline categories such as retail and dining, as well as growth in consumer loans and wealth management products.

On the enterprise side, Tencent Cloud benefited from rising demand for AI-related services, including GPU leasing and API token sales. Fees from Mini Shops' e-commerce transactions also contributed. Gross margins improved on operational efficiency.

A notable highlight was the HunYuan 3D model—now ranked the top 3D generative model on Hugging Face. Adoption is growing among game developers, 3D printing firms, and design professionals for creating high-fidelity digital assets.

Tencent says data augmentation and improved training pipelines have materially enhanced HunYuan’s geometric precision and texture fidelity.

WeChat ecosystem deepens integration

Weixin and WeChat’s combined MAU reached 1.411 billion, up 3% YoY.

Mini Programs facilitated double-digit growth in gross merchandise value (GMV) via stronger use cases in financial services, dine-in ordering, and transportation. Mini Games’ receipts rose 20% YoY, aided by upgraded engine compatibility and faster load times.

New social commerce features, such as cross-platform SKU libraries, unified loyalty programs, and “shop with friends” group-buying and aim to tighten the link between social engagement and transaction activity.

AI-powered customer service for Mini Shops, contextual citations for Official Accounts, and automated video summaries further reinforce Weixin’s role as Tencent’s central user-facing platform.

Financial performance and capital allocation

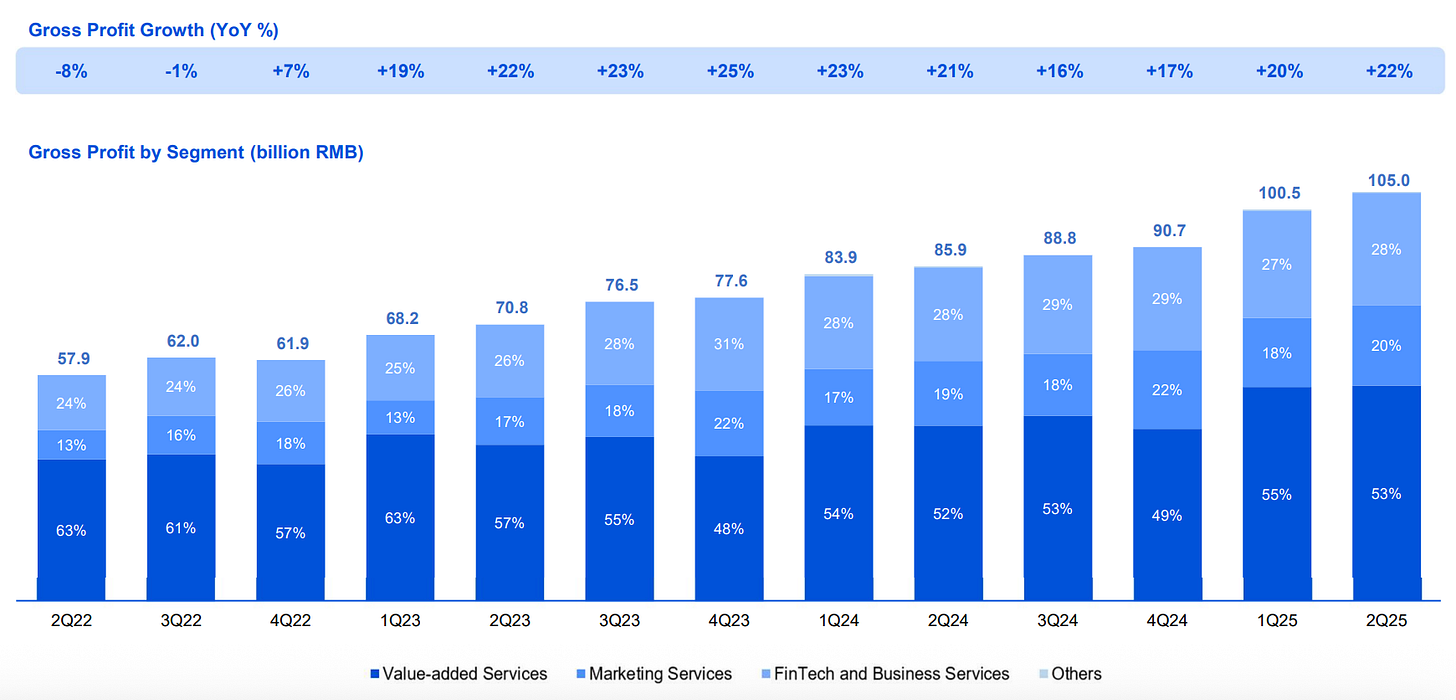

On a non-IFRS basis, Tencent’s operating profit rose 18% YoY to RMB69.2 billion, with margins widening to 38%. Net profit attributable to equity holders grew 10% YoY to RMB63.1 billion.

Gross profit climbed 22% to RMB105.0 billion, pushing the overall gross margin to 57%—its highest in recent years.

CAPEX surged 119% YoY to RMB19.1 billion, reflecting heavier investment in data centers, cloud infrastructure, and game development capabilities.

Free cash flow increased 7% YoY to RMB43.0 billion, even after share buybacks worth RMB17.8 billion and a cash dividend payout of RMB37.5 billion. Tencent ended June with RMB468.4 billion in cash and a net cash position of RMB74.6 billion.

Implications

Tencent’s Q2 2025 results underline three strategic currents with implications beyond China:

AI commercialization at scale – Tencent’s integration of generative and foundational models into games, marketing, and cloud services shows AI moving from R&D to revenue-impacting deployment.

This mirrors trends at Microsoft, Alphabet, and Meta, but with Tencent leveraging China’s super-app ecosystems for unique distribution advantages.

Resilient gaming monetization – The blend of evergreen titles with new IP launches, and the cross-pollination between domestic and overseas studios, supports a diversified revenue base less dependent on any single hit. For investors, sustained DAU growth in flagship games is a positive signal for medium-term earnings visibility.

E-commerce and fintech convergence – WeChat's commerce features, paired with Tencent’s payment rails, are creating closed-loop ecosystems that deepen user stickiness and raise merchant switching costs. This positions Tencent to capture incremental transaction and advertising revenue as consumption recovers.

Global investors should watch for regulatory developments—particularly in China’s gaming approvals and fintech oversight—that could affect Tencent’s growth trajectory. Competitive dynamics in global cloud AI services will also shape returns on its heavy CAPEX.

Sources: Tencent Q2 2025 Results Presentation, Tencent Q2 2025 Press Release.